Defensive Positioning Before The Correction?

Intermarket Macro Map: The "Smart Money" Flees to Safety While Credit Cracks Widen.

New to the Intermarket Macro Map?

In a market flooded with noise and conflicting headlines, finding true signal is the ultimate challenge. To generate consistent Alpha and trade like a professional, you need to see where capital is flowing before it becomes obvious to the crowd.

The Intermarket Macro Map gives you this institutional edge. By analyzing Intermarket relationships, we identify exactly which sectors are attracting “Smart Money” and which are bleeding out.

Crucially, this system is designed with built-in verification. By cross-referencing multiple signals, we filter out false breakouts and noise. This self-correcting mechanism gives you the conviction to ride winning trends as long as they last and only pivot when the structural data actually changes.

The Foundation of Stock Selection

This map is not just theory; it is the engine block of our entire strategy. You cannot pick the right stock if you are blind to the macro environment. Our proprietary Stock Selection System uses these signals to define the “Market Regime.” This allows us to statistically align our trades with the dominant institutional flows, dras tically increasing the probability of success while filtering out “false positives” that look good on paper but are swimming against the tide.

The Result? You stop guessing based on news and start executing based on math.

How to read the diagnosis: We track Relative Strength Ratios (e.g., Asset A divided by Asset B) using a strict “Traffic Light” system:

🟢 Green Background: Outperformance. The Asset is beating its Benchmark. Capital is rotating into this sector. (Buy/Hold)

🔴 Red Background: Underperformance. The Asset is losing to its Benchmark. Capital is rotating away from this sector. (Sell/Avoid)

⚪ Gray Background: Neutral. No clear winner. The trend is chopping or consolidating.

Important Update: The Evolution of Defy the Odds

The Intermarket Macro Map and the specific Stock Selection signals will soon move behind a paywall.

Lock in your access before the gates close, you can Pledge your support today

(enter your email to see the pledge options).

🌍 The Big Picture: The Foundation Is Cracking

The market narrative has shifted violently. We are no longer just watching a “speculative unwind”; we are witnessing a structural fracture in the market’s foundation. The Credit Market is flashing a systemic warning. Investment Grade Corporate Bonds (LQD) have lost their “Green” leadership regime, signaling that liquidity is tightening even for high-quality borrowers. When the “Smart Money” in bonds starts de-risking, equity traders should pay attention.

Simultaneously, a classic pre-correction “Cross-Asset Defensive Positioning” is unfolding. Capital is aggressively fleeing into safety sectors—Staples (XLP) and Utilities (XLU) are outperforming, while high-flying Discretionary and Software names are being liquidated.

Why hasn’t the index collapsed yet? Because the remaining liquidity is desperately rotating into specific “Islands of Strength”:

The “Reflation” Survivors: Small Cap Value (IWN), Regional Banks (KRE), and Energy (XLE) are the last standing pillars of the cyclical trade.

AI Hardware (SMH): The crash in Software is financing a narrow squeeze in Semiconductors.

The Verdict: The market is currently schizophrenic. Bond markets are pricing in a “Risk-Off” event, while a narrow cohort of equities is partying like it’s a “Reflation” boom. Historically, this divergence (Credit Weakness + Defensive Rotation) is the immediate precursor to a broader market correction.

⚔️ Actionable Playbook: Tactical Rotation with Cash Protection

The era of “blindly buying the index” is over. The deterioration in Credit (LQD) dictates that Risk Management is now your primary job.

Raise Cash Immediately: The flip in Investment Grade Credit is a major sell signal. You must reduce gross exposure and build a cash buffer to weather the potential volatility.

Long The “Rotation” (With Tight Stops): If you must be long, align with the velocity. Regional Banks (KRE) and Small Cap Value (IWN) are the only areas showing genuine demand. Energy (XLE) remains the best hedge against inflation, despite the utility-driven pullback.

Hardware Over Software: The “AI Trade” is now exclusively a Semiconductor (SMH) story. Software is dead money; do not catch the falling knife.

Japan Takes The Crown: In the international arena, Japan (EWJ) has overtaken Europe. It is the highest-velocity trade in the developed world.

Kill / Avoid: Crypto (BTC), Innovation Tech (ARKK), and Floating Rate Debt (BKLN). These assets are toxic in a liquidity-constrained environment.

You already got the pre-warning this week, plus an action plan for what to watch during the correction and what to buy when the dust settles:

🎯 CRITICAL TRIGGERS: The Last Lines of Defense

Bullish Stabilizer: LQD/IEF Reclaiming Green. This is non-negotiable. We need the Investment Grade credit market to stabilize. If LQD cannot flip back to “Green,” any equity rally is likely a “Bull Trap” built on shaky foundations.

Bearish Kill-Switch: The Carry Trade & Small Cap Failure. Two final dominoes are holding the market up. If they fall, we enter a full systemic “Risk-Off” event:

AUD/JPY (The Carry Trade): The trend is Green, but price action is stalling. If this ratio cracks and flips to Gray, the leverage supporting the entire global risk trade unwinds instantly.

IWM/SPY (Small Caps): Small Caps are currently the engine of the market. If IWM loses its “Green” status and fades to Gray, the rotation narrative dies, and there is nothing left to support the S&P 500.

Final Warning: Do not be a hero here.

The combination of Defensive Rotation (XLU/XLP) and Credit Stress (LQD) is the market screaming that the risk of a correction is higher than the potential reward. Trade smaller, trade tighter.

A Block-by-Block Deep Dive

Leadership, Breadth & Speculation: Small caps are the only game in town

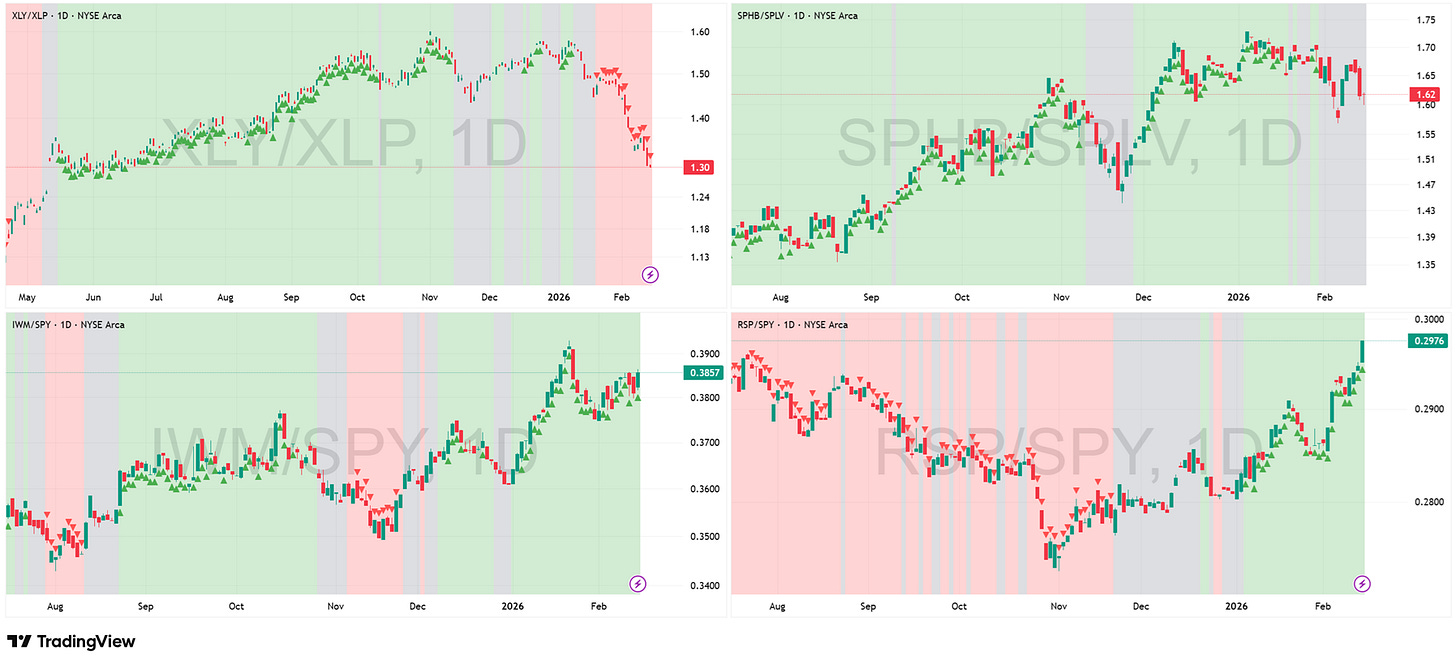

Ratios: XLY/XLP, SPHB/SPLV, IWM/SPY, RSP/SPY

Key Development This Week: The market has bifurcated into a defensive crouch and a speculative frenzy. The Cyclical Engine (XLY/XLP) remains broken in a deep Red trend, but this is increasingly driven by a flight to safety into Staples (XLP) as investors hide from liquidity constraints and sector-specific volatility. While High Beta (SPHB) remains trapped in Gray consolidation, the real story is the explosion in Breadth. IWM/SPY and RSP/SPY have decoupled from the defensive tone, ripping higher in a confirmed Green regime. Small Caps are effectively the only game in town for alpha, ignoring the defensive posturing seen in the large-cap ratios.

Actionable Playbook: Focus entirely on the IWM and RSP breakout. The defensive bid in Staples is a warning sign for the broader index, but it is not stopping the rotation into smaller companies. You must be long Small Caps and Equal Weight here, as they are the only vehicles ignoring the liquidity drag.

Many just realizing this, but we are in the trade for a month now.

Triggers:

Bullish Trigger: SPHB/SPLV Break to Green. For the massive Small Cap rally to sustain its momentum, we do not even need XLY to rally; we just need XLY/XLP to stabilize in absolute terms.

Bearish Trigger: RSP/SPY Fading to Gray OR SPHB/SPLV Flipping to Red. If High Beta collapses into Red, the risk-on trade in Small Caps is finished for now.

AI Capex & Industry Cycle: Hardware Dominance & Defensive Utilities

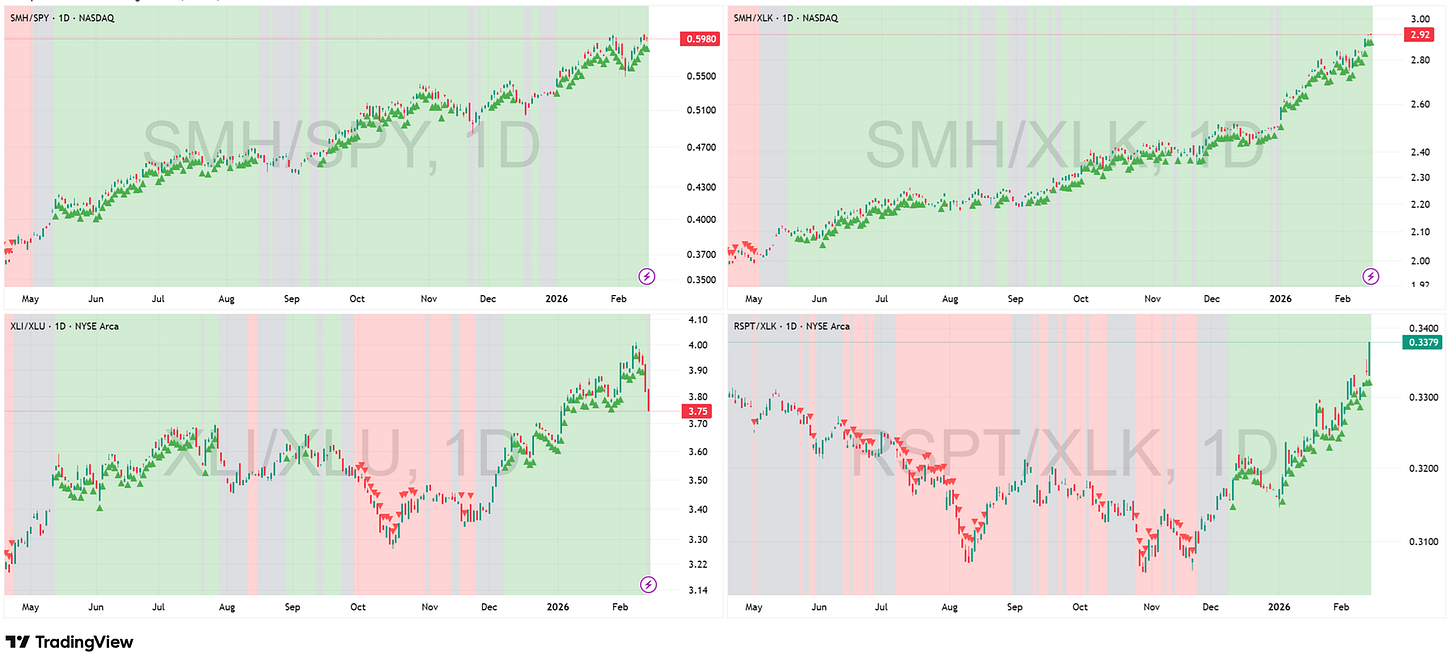

Ratios: SMH/SPY, SMH/XLK, XLI/XLU, RSPT/XLK

Key Development This Week: The “Fortress” stands, but with a distinct defensive twist. The Tech complex is being driven by a violent “Hardware over Software” rotation. The vertical spikes in RSPT/XLK and SMH/XLK are heavily influenced by the Software Crash (the denominator is falling), masking the fact that breadth within tech is actually quite narrow. Crucially, the drop to Gray in XLI/XLU is not a signal of Industrial weakness. XLI remains structurally sound. The ratio is being compressed by an explosive breakout in Utilities (XLU), mirroring the defensive flight to safety we saw in Staples (XLP). This is a “Denominator Event,” not a trend change in the physical economy.

Actionable Playbook: Do not misinterpret the XLI/XLU fade. Do not sell your Industrials; they are simply being outpaced by a defensive utility squeeze. The play remains: Long Semis (SMH) as the undisputed leader, and avoid Software-heavy vehicles that are dragging down the broader tech indices.

Triggers:

Bullish Trigger: XLI/XLU Stabilizing. We don’t need XLU to crash, we just need the panic-buying in Utilities to cool off so the Industrial trend can reassert itself in the ratio.

Bearish Trigger: SMH/XLK Flipping to Gray. If Semis cannot outperform even when the Software denominator is weak, it indicates total exhaustion in the Hardware trade.

Factors & Themes: Value Is The New Momentum

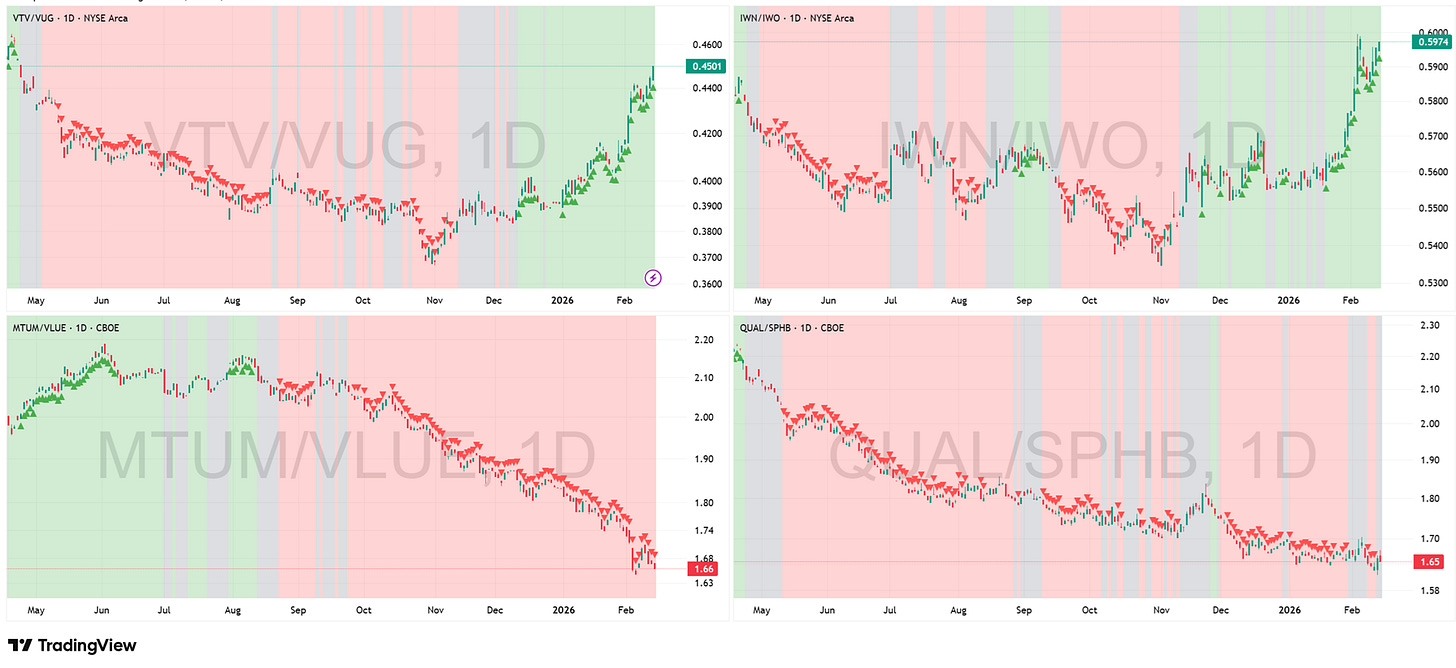

Ratios: VTV/VUG, IWN/IWO, MTUM/VLUE, QUAL/SPHB

Key Development This Week: The rotation has turned into a rout. The “Value” factor is not just outperforming; it is actively destroying Growth. VTV/VUG (Large Value) and IWN/IWO (Small Value) are vertical in deep Green trends, confirming that capital is aggressively fleeing “expensive perfection” to buy “cheap cash flow.” The collapse in MTUM/VLUE (Momentum vs. Value) to fresh lows confirms that “Winners” of the past year are now the primary funding source for this rotation. However, note the nuance in QUAL/SPHB (Quality vs. High Beta). It remains stuck in Gray. Investors are buying Value, but they are not blindly buying “Junk.” They are rotating into cheaper assets but retaining a preference for Quality over pure speculative High Beta.

Actionable Playbook: Maintain the aggressive Value tilt we have been advocating for months. The strategy remains: Sell “Momentum” rips to fund “Value” pullbacks. However, a critical warning on Relative vs. Absolute returns: These charts show Value beating Growth. If the defensive posturing we see elsewhere (XLP, XLU) drags the overall S&P 500 lower, Value stocks can still fall in price even while outperforming relative to Tech. Do not confuse “beating the Nasdaq” with “immunity to a correction.”

Triggers:

Bullish Trigger: QUAL/SPHB Breaking to Red. If High Beta can finally outperform Quality, it signals that the “Value Rally” is broadening into a full-blown “Junk Rally,” implying massive risk appetite.

Bearish Trigger: QUAL/SPHB Flipping to Green. If Quality starts outperforming, it suggests the rotation is turning defensive (flight to safety) rather than offensive (seeking yield).

Reflation & Deflationary Pulse: Energy Hits The Defensive Wall

Ratios: XLE/XLU, XME/GLD, GDX/GLD, GDXJ/GDX

Key Development This Week: The Reflation trade has collided with the “Flight to Safety.” XLE/XLU remains in a Green regime, but the ratio has suffered a sharp pullback. Crucially, this is not because Energy (XLE) is broken—structural oil demand remains intact. The drop is driven entirely by the denominator: the panic-buying of Utilities (XLU) we identified in the Industrial block. Meanwhile, XME/GLD is stalling, not failing. After a powerful impulsive run, Industrial Miners are digesting gains in a lateral Gray consolidation. This is a technical pause to work off overbought conditions, not a reversal of the trend. Gold Miners (GDX, GDXJ) remain the laggards, stuck in choppy Gray action.

Actionable Playbook: Do not get shaken out of Energy positions by the XLE/XLU dip. This is a “False Weakness” signal caused by the defensive mania in Utilities. Hold your XLE. For XME, patience is key; the sector is coiling after its recent surge. We are waiting for this consolidation to resolve higher to confirm the next leg of the commodity cycle.

Triggers:

Bullish Trigger: XME/GLD Break to Green. We need the Industrial Miners to finish this consolidation and flip back to Green. This would confirm that the “stall” is over and the trend is resuming.

Bearish Trigger: XLE/XLU Flip to Gray. If the defensive squeeze in Utilities is strong enough to flip this ratio Gray, it neutralizes the only remaining cyclical uptrend.

Liquidity: No Sanctuary In Credit

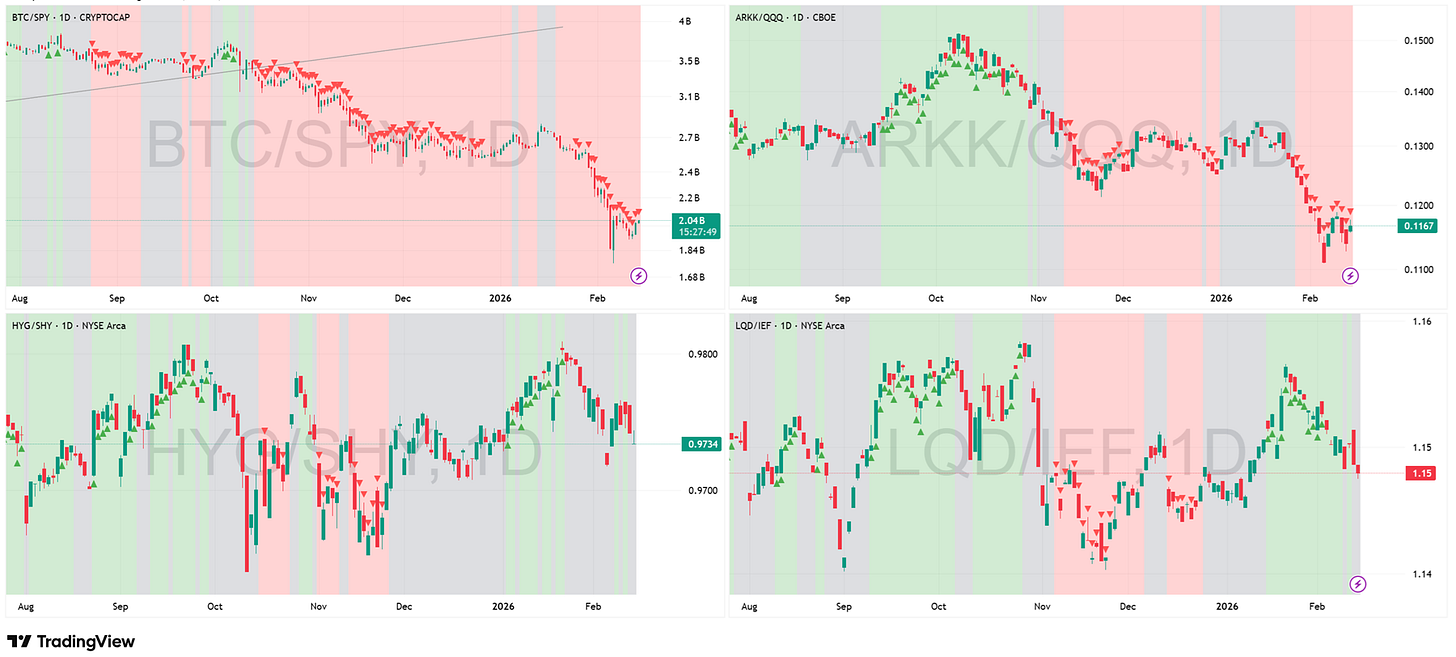

Ratios: BTC/SPY, ARKK/QQQ, HYG/SHY, LQD/IEF

Key Development This Week: The “infection” has breached the containment wall. We warned last week that Investment Grade credit (LQD/IEF) was showing fatigue; this week, the dam broke. The ratio has lost its Green regime and collapsed into Gray. This is a critical escalation. It means the liquidity drain is no longer just punishing “reckless speculation” (BTC and ARKK remain in deep, catastrophic Red trends); it is now forcing liquidation in high-quality corporate paper. When even “safe” corporate bonds cannot outperform Treasuries, it signals a systemic tightening of financial conditions. The chart for LQD/IEF looks particularly ugly, with heavy selling pressure suggesting institutions are raising cash by selling what they can, not just what they want to.

Actionable Playbook: Raise cash. The “safe haven” trade within the credit market has failed. You cannot hide in Corporate Bonds if LQD is breaking down relative to Treasuries. The Red regimes in BTC and ARKK are “investable death zones”—do not touch them. Now that LQD has joined the Gray/Red camp, the signal is to reduce credit risk across the board.

Triggers:

Bullish Trigger: LQD/IEF Reclaiming Green. We need High Grade credit to stabilize immediately. If this ratio flips back to Green, it suggests the liquidity scare was temporary.

Bearish Trigger: HYG/SHY Flipping to Red. Junk bonds are currently chopping in Gray. If High Yield follows Investment Grade and breaks down into Red, we are looking at a full-blown credit event.

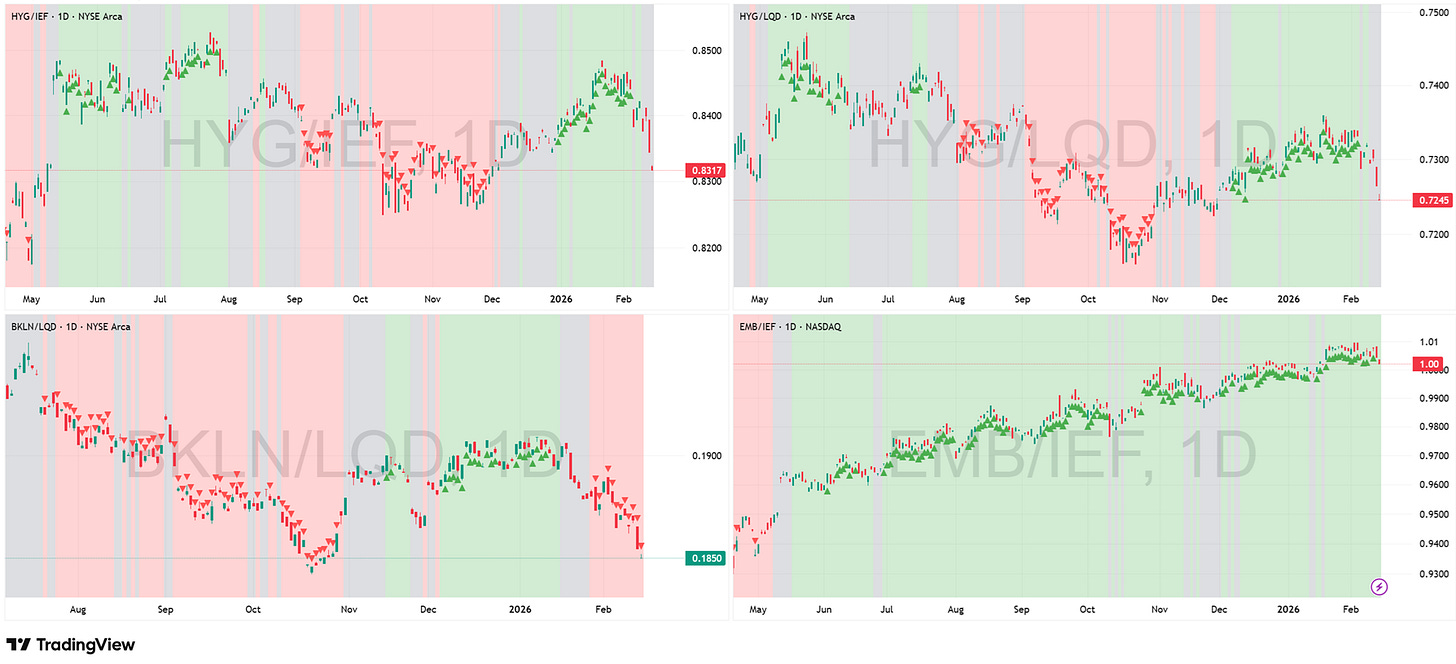

Core Credit: The Hunt for Yield Is Over

Ratios: HYG/IEF, HYG/LQD, BKLN/LQD, EMB/IEF

Key Development This Week: The “fatigue” we warned about last week has officially turned into a breakdown. The credit market has moved to a “Risk-Off” footing. Both HYG/IEF and HYG/LQD have lost their Green regimes and flipped to Gray. This is a major structural shift. It means High Yield corporate bonds are no longer generating alpha over Treasuries or Investment Grade debt. The “Carry Trade” is effectively dead. BKLN/LQD (Bank Loans) remains a disaster zone in deep Red, confirming the market hates floating rate risk. The only survivor is EMB/IEF (Emerging Markets), which remains Green, but the price action has turned ugly and volatile. It is now an isolated island of risk in a sea of defensive rotation.

Actionable Playbook: The credit cycle has turned. You should no longer be chasing yield in junk bonds. The flip to Gray in HYG/LQD is your sell signal. Capital is rotating up the quality ladder (into Treasuries/Cash) and leaving credit risk behind. If you hold EMB, tighten your stops aggressively; it is likely the next domino to fall given the deterioration in the rest of the block.

Triggers:

Bullish Trigger: HYG/LQD Reclaiming Green. Unless Junk bonds can prove they are better than Investment Grade again, the “risk-on” credit trade is suspended.

Bearish Trigger: EMB/IEF Flip to Gray. This is the final capitulation. If Emerging Markets lose their Green status, there is zero credit risk working anywhere in the global market.

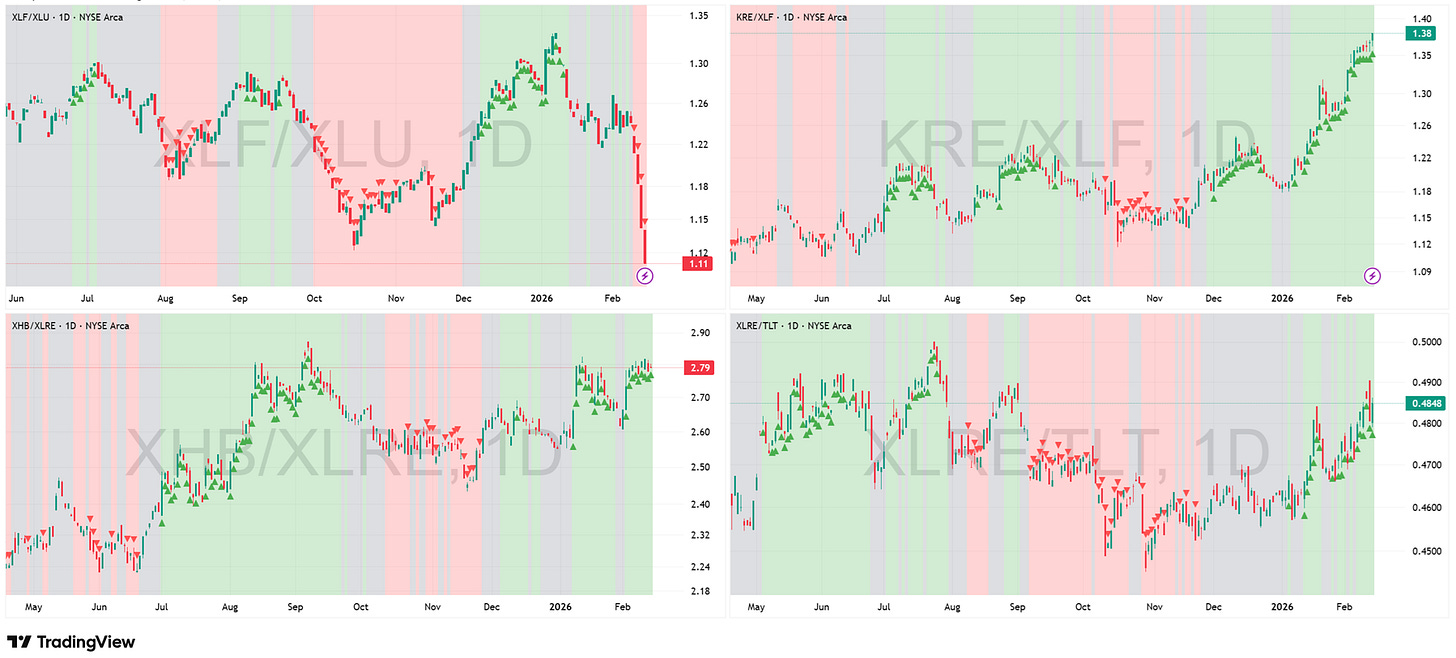

Interest Rate & Duration: Regionals Decouple From The Financial Train Wreck

Ratios: XLF/XLU, KRE/XLF, XHB/XLRE, XLRE/TLT

Key Development This Week: A massive divergence has torn the Financial sector apart. XLF/XLU (Financials vs. Utilities) has been completely annihilated, crashing vertically into a deep Red regime. This is not just a “denominator” issue driven by the Utility squeeze; the large-cap Financials (XLF) are facing liquidation. However, a miraculous decoupling is happening: KRE/XLF is skyrocketing in a vertical Green impulse. Regional Banks (KRE) are ignoring the sector-wide rot, rallying in both relative and absolute terms. They are the only “Rate Sensitive” vehicle showing genuine demand. Meanwhile, the “Real Asset” trade holds firm, with XHB/XLRE (Homebuilders) and XLRE/TLT (Real Estate vs. Bonds) maintaining their Green trends despite the volatility.

Actionable Playbook: Do not buy “Financials” (XLF); buy Regional Banks (KRE). The broad sector is toxic, but KRE has successfully detached itself from the Large Cap weakness.

This is a stock-picker’s market where you must be precise.

Long Regionals and Homebuilders (XHB), but avoid the broader XLF ETF which is being dragged down by the defensive rotation.

Triggers:

Bullish Trigger: XHB/XLRE New Highs. If Homebuilders can break out relative to REITs, it confirms the “Construction Cycle” is immune to the Financial sector’s drama.

Bearish Trigger: KRE/XLF Flip to Gray. This is the lynchpin. KRE is the only thing working in this block. If it stops outperforming the crashing XLF, the entire trade is dead.

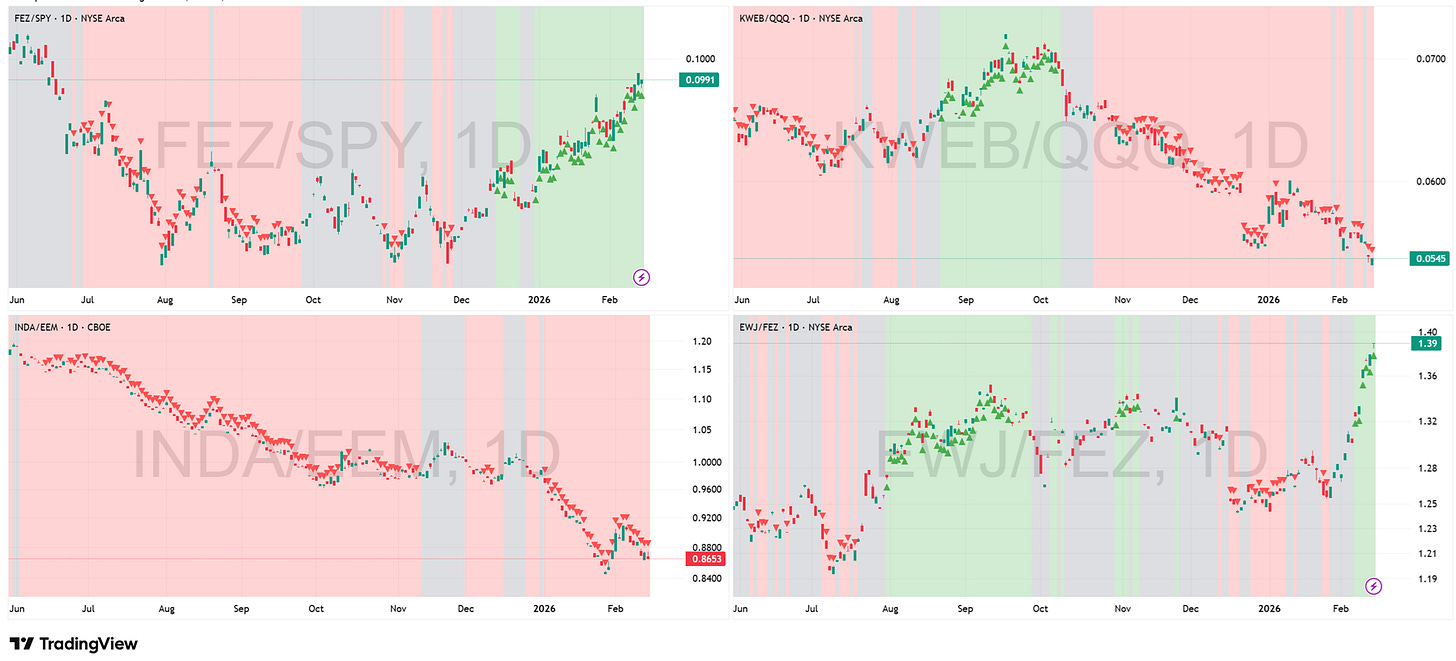

Global Relation: Japan Takes The Crown

Ratios: FEZ/SPY, KWEB/QQQ, INDA/EEM, EWJ/FEZ

Key Development This Week: The hierarchy of global capital is brutally clear. While FEZ/SPY (Europe vs. USA) remains a solid Green trend, confirming the structural flow out of American assets, the torch of leadership has been passed. EWJ/FEZ (Japan vs. Europe) has gone vertical. This is now the “Best of the Best” chart on the board.

Japan is generating massive alpha over Europe, which is already beating the US.

It is the highest velocity trade in the developed world. Conversely, the Emerging Market disaster continues. KWEB/QQQ (China Tech) and INDA/EEM (India) are trapped in deep Red liquidation trends. There is no bottom in sight for EM; the capital is exclusively flowing into Developed Market cyclicals.

Actionable Playbook: Aggressively Rotate into Japan (EWJ). If you are holding international exposure, your biggest weight must be here. The breakout in EWJ/FEZ signals that Japan is the new momentum king. Maintain exposure to Europe (FEZ) as a core holding, but treat Japan as the alpha generator. Continue to ignore the “cheap valuation” siren song in China and India; they are cheap for a reason.

Triggers:

Bullish Trigger: KWEB/QQQ Flip to Gray. We cannot touch Emerging Markets until the China Tech bleeding stops. A flip to Gray is the minimum requirement for a bottom.

Bearish Trigger: EWJ/FEZ Flip to Gray. If Japan loses its relative strength against Europe, the “high velocity” leg of the international trade is over.

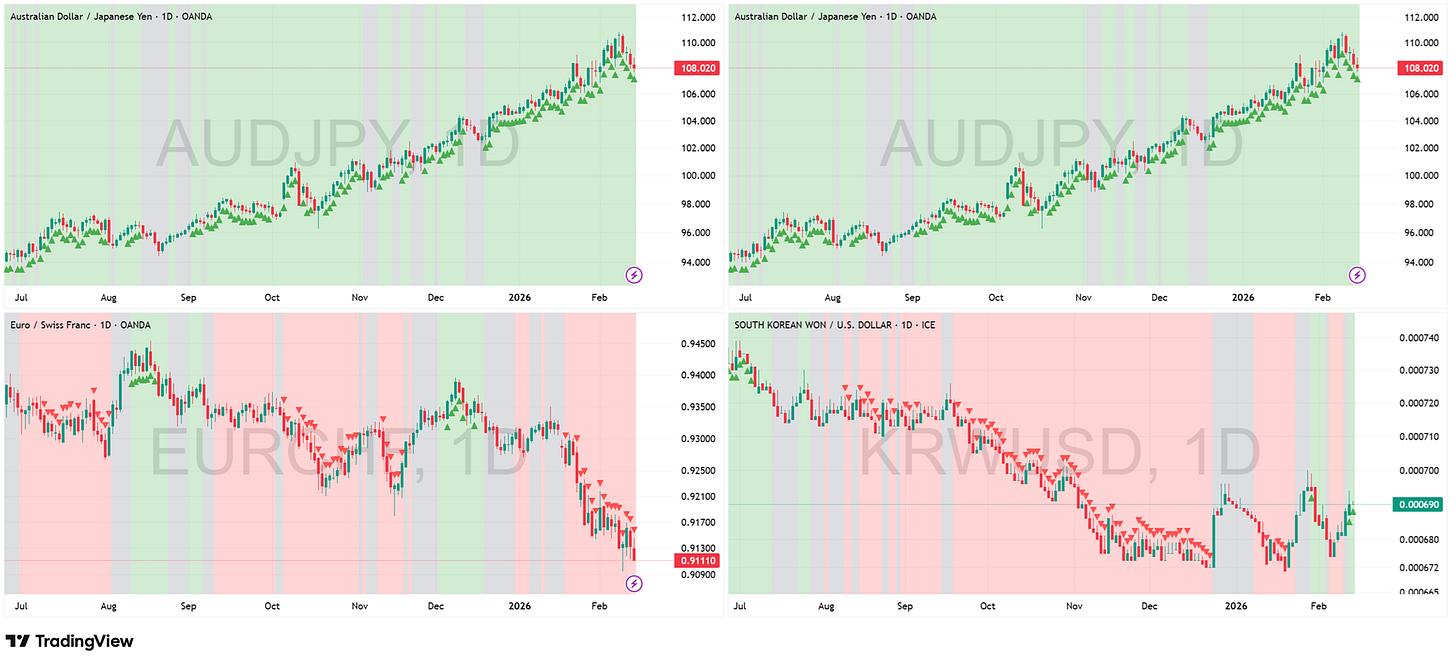

FX-Based Risk Gauges: The Carry Trade Stalls

Ratios: AUD/JPY, CAD/JPY, EUR/CHF, KRW/USD

Key Development This Week: The “Risk-On” signal from the currency market is flashing a warning. While AUD/JPY and CAD/JPY remain in Green regimes, the price action is becoming highly suspicious. Instead of accelerating, the Carry Trade is stalling at the highs, leaving “topping tails” that suggest exhaustion. If we do not get immediate trend continuation here, the entire leverage construct supporting the equity rally is in danger. Meanwhile, a surprise shift has occurred in KRW/USD (Korean Won). It has flipped back to Green, offering a tentative sign of life for the global industrial cycle. However, this is not a breakout yet; it is merely chopping within a range. EUR/CHF remains deep Red, confirming that European traders are still buying “Crash Protection” (Francs) despite the equity rally.

Actionable Playbook: Tighten your stops on the Carry Trade (AUD/JPY). The Green signal is valid, but the momentum is fading. We are at a “Make or Break” point: if the Yen starts strengthening here, the equity rotation will violently unwind. Watch KRW/USD closely. A flip to Green is a good start, but until it breaks out of its multi-month range, it is just noise. If it clears the range, it validates the “Global Recovery” thesis.

Triggers:

Bullish Trigger: KRW/USD Range Breakout. We need the Won to clear the recent highs to confirm that the “Green” signal is real demand and not just a dead-cat bounce.

Bearish Trigger: AUD/JPY Flip to Gray. This is the “Kill Switch” for the entire market. If the Carry Trade breaks down from this stalled level, risk assets globally will correct.

Disclaimer: Nothing here is financial advice. These are reflections on macroeconomics and markets, meant to spark ideas and sharpen decision-making. To truly Defy the Odds, think independently, question everything, and do your own homework.

Thanks for this breakdown appreciate it.

What’s your position on miners? (Gold, silver, base metals)

I recently sold all of my more leveraged/speculative miners. But have held on to the big boys and royalties.